WY Holding Company + SC Operating LLC vs. a Simple SC LLC: Which Setup Is Right for You?

If you’re launching in South Carolina, you’ve got two practical paths: a straightforward SC LLC or a Wyoming holding company that owns your SC operating LLC. Here’s how to decide—privacy, scaling across states, compliance, and cost—without the overwhelm.

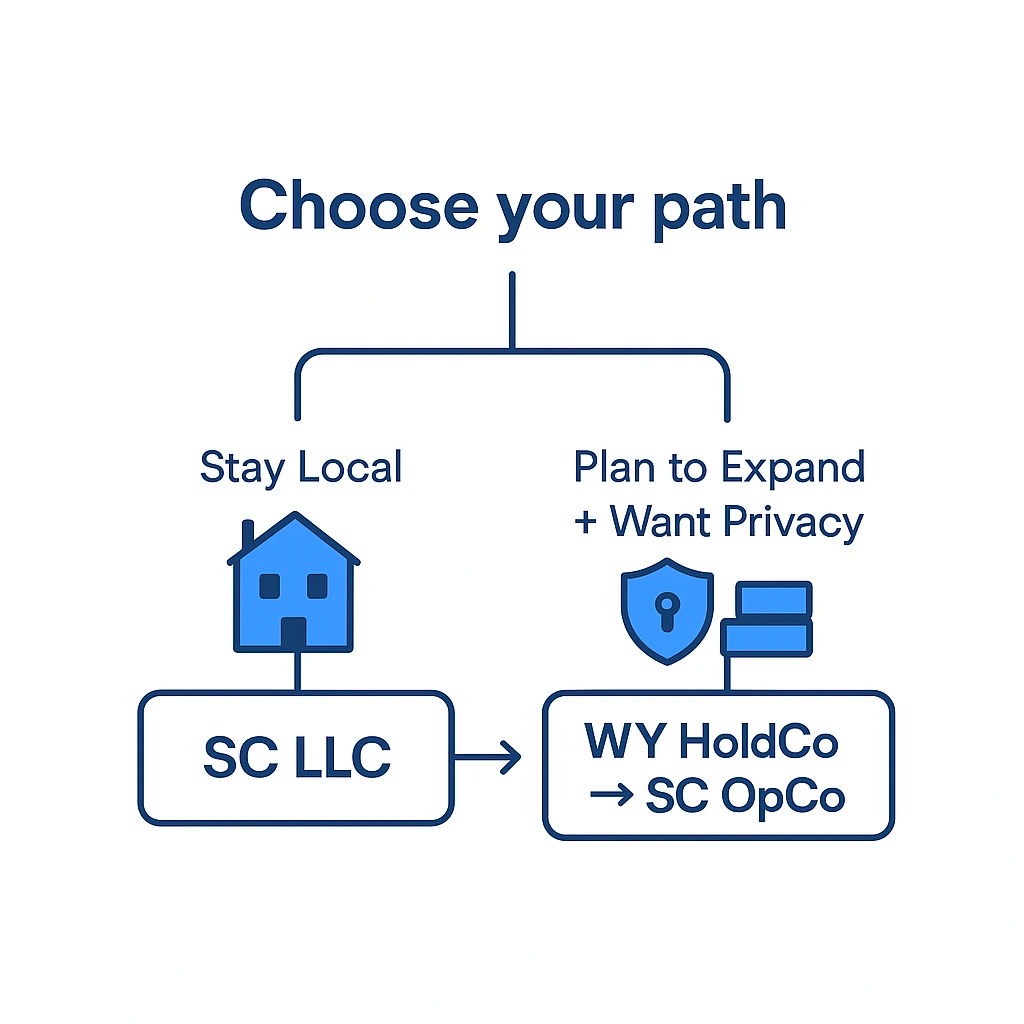

The Two Paths in Plain English

Path A — Simple & Local (SC LLC)

- One entity: file SC Articles, appoint an SC registered agent

- Get EIN, bank docs, and local (city/county) license if required

- Register with SCDOR (MyDORWAY) for retail/sales/withholding as needed

Best for founders staying in South Carolina for the foreseeable future.

Path B — Scalable & Private (WY HoldCo → SC OpCo)

- Form a WY holding LLC (owner) + a separate SC operating LLC (does business)

- Keep ownership/ IP “upstairs” and operations “downstairs”

- Easier to add other states later with the same holding company

Best for privacy on public filings + multi-state plans.

Why Founders Pick a Wyoming Holding Company

- Public-record privacy: WY doesn’t list owners on Articles, reducing casual doxxing and junk mail.

- Multi-state readiness: Add NC/GA/FL later by creating new OpCos under the same HoldCo or foreign-qualifying existing ones.

- Cleaner risk separation: Keep capital/IP at HoldCo; keep customer activity at OpCo.

Reality check: two entities mean two registered agents and two annual renewals—higher admin than Path A.

South Carolina Compliance (Quick Map)

- Registered agent: physical SC street address (no PO boxes).

- Retail & tax accounts: set up MyDORWAY for sales/use tax, withholding, etc., as needed.

- Local license: no statewide license—city/county rules vary.

- Annual report: most SC LLCs don’t file one unless taxed as a corporation (then CL-1 & corporate filings apply).

BOI (Beneficial Ownership) — What Changed?

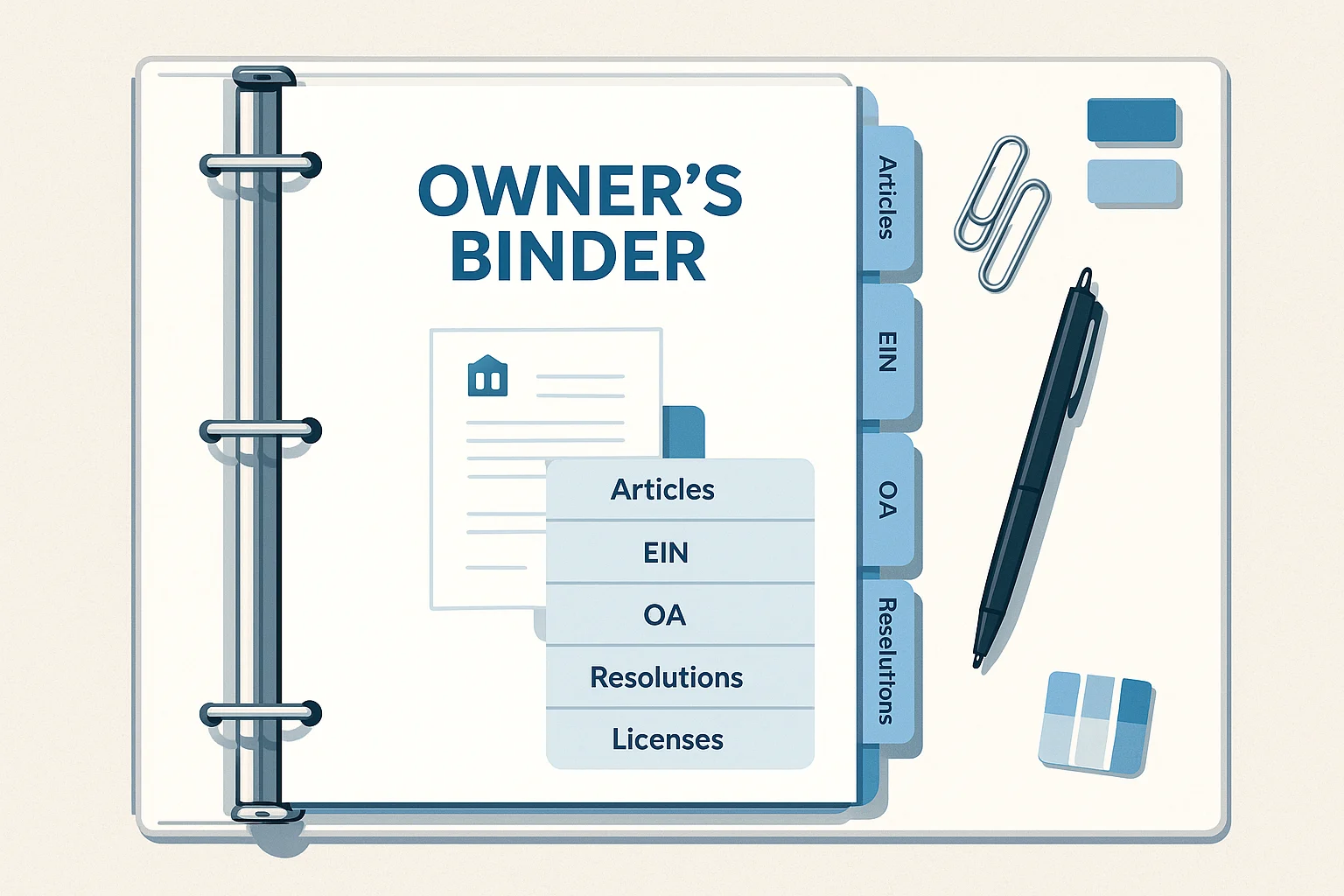

Federal “BOI” reporting requirements have evolved. As of early 2025, FinCEN issued guidance narrowing who must file. If both entities are U.S.-formed, burdens may be reduced—but banks will still verify owners for their own compliance. Keep a clean Owner’s Binder with Articles, Operating Agreement(s), EIN letter(s), resolutions, and a simple ownership chart. Always confirm current rules with your attorney/CPA.

Cost & Complexity — Fast Comparison

| Item | Path A: SC LLC | Path B: WY HoldCo → SC OpCo |

|---|---|---|

| Entities & filings | 1 | 2 |

| Registered agents | 1 | 2 |

| Addresses | 1 | 2 (WY + SC) |

| EINs / bank packets | 1 | 1–2 |

| Privacy on public filings | Standard | Higher (via WY) |

| Expansion readiness | Add later | Built-in |

60-Second Decision Guide

Choose Path A (SC LLC) if:

- You’ll operate only in South Carolina for 2–3 years

- You want the lowest complexity and cost now

- Public listing of your name doesn’t bother you

Choose Path B (WY → SC) if:

- You care about privacy on public filings

- You expect multi-state activity within a year

- You want cleaner separation of assets vs operations

Launch Checklist (Both Paths)

- Name check + confirm structure (SC-only vs WY+SC)

- Registered agent(s) set

- Articles filed (timestamped copies saved)

- Operating Agreement(s) + EIN(s) + banking resolutions

- Virtual address + mail rules (if using)

- MyDORWAY setup + Retail License (as needed)

- Local (city/county) business license

- Owner’s Binder + compliance calendar (renewals, licenses, RA)

Launch Without the Paperwork Headache

We file the entities, coordinate registered agents & virtual addresses, handle EIN and banking documents, set up MyDORWAY/local licensing, and deliver your Owner’s Binder + compliance calendar.

Not legal or tax advice. Ameen Systems provides administrative/operational services and coordinates with your attorney/CPA if needed.

Last updated: August 2025 • Author: Ameen Systems